The specialized insurer

Overview:

Our insurance client, an international leader in their specialized field, had neither the insights nor the resources to properly manage all the leads they were generating. We formalized their data setup, implemented a custom lead-scoring system, and streamlined KPI reporting to enable truly data-driven decision-making.

Services:

- Data analysis

- Lead scoring

- Dashboarding

The challenge

It’s a strange problem to have, but our client was generating too many leads. As a result, their limited resources could only target a small subgroup for upselling paid insurance and membership products. They simply weren’t able to target the right leads to improve operational efficiencies and drive revenue.

Further, each new lead provided a rich set of data through disparate systems in a non-standardized format. So, while there was plenty of data available, there was no way to view, analyze, or action on it—which meant decision-makers had no confidence that their strategies were informed by data.

- Lay the foundations for data-driven decision-making

- Address operational inefficiencies

- Increase sales and revenue

The solution

We implemented a formalized structure for all incoming data and disseminated this data in a digestible report for key audiences. Tangible, actionable insights were quickly uncovered, enabling both teams to start addressing underperforming business strategies.

The call center was identified as the most inefficient use of resources. Designing and deploying a predictive lead-scoring model, we empowered the call center to contact leads that could more than likely be convinced to convert with minimal prompting.

BOLD BUSINESS DECISIONS

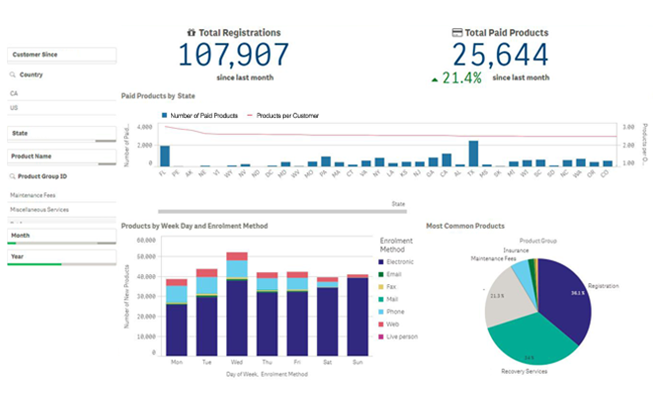

Data was ingested, cleaned, and loaded to our business intelligence software. We developed an online dashboard that summarized monthly performance through a streamlined KPI framework. Data never before accessible to the business’ decision makers could now be leveraged for swift action.

LEAD NURTURING DONE RIGHT

Through machine learning, we combined lead characteristics, lead behavior, and past product information to predict a lead’s probability of purchasing insurance. Iterative testing of the lead scoring model ensued to optimize which leads should be contacted.

FORECASTING SUCCESS

We analyzed high and low performing stores based on software used, products offered, and the characteristics of both previous and prospective customers. Performance was measured according to predicted success as some stores had a poor prospective lead pool. We used customer profiles created from the lead scoring model to predict each store’s success.

The Architect

The Activist

The Advocate

The bold decision

- By narrowing the focus to leads most likely to become paying customers, our client was able to better allocate their limited resources and achieve a substantially improved sales outcome

Ready to get started?

We can help you create transformational change if your data has become an afterthought, untapped resource, or decision-making blind spot—and it all starts with a friendly chat. Let’s get started!